Many online businesses start as small enterprises managed and run by one person, probably with a family member as an assistant.

When the business picks up, they hire one or more full-time staff to increase production and help with administrative tasks like managing inventory or paying business taxes.

If you are at this stage in your business, your legal responsibility is to provide your employees with 13th month pay. In this article, we’ll briefly discuss the legalities behind the it and then show tips and examples on how to compute the mandatory 13th-month pay in the Philippines.

Also read: Take Note of These Tax Exemptions for MSMEs

The 13th Month Pay Law

The 13th month pay is a benefit given to all Filipino employees. It’s equivalent to one-twelfth (1/12) of an employee’s salary in one calendar year.

The Philippines is one of the countries that has made 13th month pay mandatory. It’s additional annual compensation for employees on top of their monthly salaries, benefits and other performance bonuses.

is mandatory.

Employees can file legal action if their employer fails to follow this mandate. Knowing how to compute 13th month pay is vital for any business owner with full-time employees.

The original 13th Month Pay Law was penned by labor leader and human rights advocate, Zoila de la Cruz, and signed by then president Ferdinand Marcos on December 16, 1975.

However, the law only granted the benefit to employees who received less than Ph1,000 monthly. It wasn’t until August 13, 1986, after Pres. Corazon Aquino amended the law and made the 13th month pay mandatory for all employers.

13th month pay vs Christmas bonus

While Filipinos often refer to 13th-month pay as a bonus, it’s different from a Christmas bonus.

A Christmas bonus may generally be related to employee performance or tenure and isn’t required by law. It can also be given based on a company’s financial performance for the year.

Meanwhile, as pointed out earlier, the 13th month pay is mandatory regardless of an employee’s or the company’s performance.

13th Month Pay Cheat Sheet

- Mandatory for all employers of Filipino workers

- Must be paid in full on or before December 24

- May also be paid in two installments, usually in June and December

- Only the “basic salary” is included in the computation. Benefits like Cost of Living Allowance (COLA), overtime pay, night differential and cash conversion of vacation and sick leave credits are excluded – except if these benefits are included in the basic salary as stated in the employment contract.

- The 13th month pay is not subject to tax. However, the TRAIN Law states if the 13th month pay plus other benefits exceed PH90,000, the excess will be subject to tax.

Who are eligible for 13th Month Pay?

- All rank-and-file employees in the private sector who worked at least one month within the calendar year.

- This benefit should be given regardless of position, designation or employment status.

- Employees who resigned or terminated before the scheduled disbursement of the 13th month pay are also entitled to a prorated rate.

- Household help (under the Domestic Workers Act or “Batas Kasambahay”)

Who Are NOT Eligible for 13th Month Pay?

- Managers (it’s up to the company to give them this benefit)

- Government employees (all those covered by civil service law)

- Persons in personal service of another

- Employees who earn purely by commission or task basis

- Freelancers

How to Compute the 13th Month Pay

According to its definition, the 13th month pay is equivalent to one month’s salary in a calendar year. As such, for employees whose monthly basic salary is the same all year is computed as:

13th month pay = total annual salary / 12

Computing With Absences

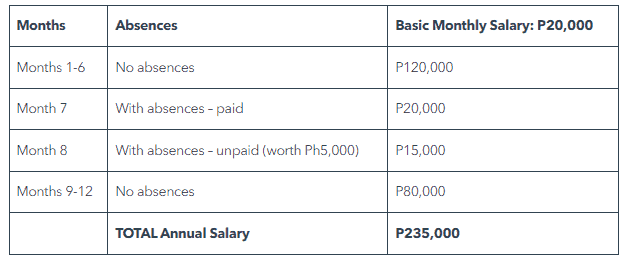

Following the definition, deductions on the basic salary because of unpaid absences will also factor into the calculation. Here’s a sample calculation of 13th month pay with absences:

(13th month pay = (total annual salary – non-paid absences) / 12)

Total Annual Salary = P235,000 / 12

13th Month Pay = P19,583.33

Computing for Resigned/Terminated Employee

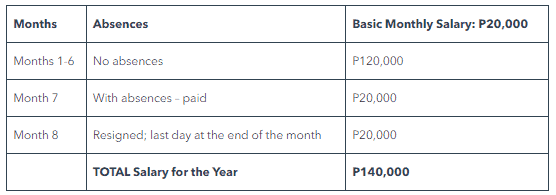

As long as an employee has worked one full month in the calendar year, he or she is entitled to receive 13th month pay for the number of months in the company (prorated calculation). Here’s how to compute 13th month pay for resigned employee:

(13th month pay = total annual salary (minus non-paid absences, if any) / months worked)

Salary for the Year = P140,000 / 8

13th Month Pay = P17,500

Who Are Exempt from Paying the 13th Month Pay?

The law exempts the following employers from giving this mandatory benefit:

- The government

- Government-owned and controlled corporations (GOCCs)

- “Distressed employers” whose businesses are not doing well may file for an exemption to DOLE.

- Employers already paying the equivalent of 13th month pay to their employees.

- Employers of people who are paid solely on commissions and people in personal service to another.

Do I Need to Hire an Accountant?

If you’re just starting an online business or opening a small shop, it helps to consult a certified public accountant who can help you register your business, set up your books and maybe even an accounting and bookkeeping software.

Once you have the essentials, you can study bookkeeping and financial management yourself or delegate it to a trusted individual. However, once your business grows, and you need to hire more full-time employees, it may become necessary to hire an accountant.

Evaluate your situation:

- How many employees are you calculating 13th month pay and taxes for? Can you handle the additional workload?

- Can you afford to hire an accountant?

- Can you recoup the cost of hiring an accountant, whether full-time or a consultant?

As with calculating business taxes, determining the 13th month pay of every employee should be efficient and accurate. Apart from fulfilling legal obligations, paying their 13th month pay on time can lift your employees’ morale and encourage them to give their best at work.

Employees are the lifeblood of a business; if you want your business to prosper, you must also meet your employees’ expectations.

For employees: How to invest your 13th month pay wisely?

Investing your 13th-month pay is a wise financial decision that can help you grow your money over time. If you have an entrepreneurial spirit, there are several investment options available, depending on your financial goals, risk tolerance and investment horizon.

or starting your own business.

Here are five investments you can explore:

Open a savings account. One of the safest options is to deposit your 13th-month pay in a high-yield savings account. Look for accounts with competitive interest rates and minimal fees.

Invest in Mutual funds Unit Investment Trust Funds (UITFs). You can start investing in Mutual funds and UITFs for as low as Ph1,000-5,000. This is a good option for those who want professional management of their investments.

Put it in a time deposit. Time deposits offer higher interest rates than regular savings accounts, but your money will be locked in for a specific period, usually ranging from a few months to several years.

Buy stocks. Consider investing in the Philippine Stock Exchange (PSE). You can open a stock trading account with a brokerage firm and start buying shares of publicly traded companies. Be aware, though, that investing in stocks carries a higher level of risk.

Start a small business. Of course, our best recommendation is to open your own business. If you have a business idea or want to start a small venture, consider using your 13th-month pay as seed capital.

Browse through our blog for more helpful articles about starting and growing your business.

If you’re an MSME, take note of these benefits you can get:

8 Government Programs for Micro-Businesses

Govt. Benefits for Solo Parent Entrepreneurs

Ninja Van Celebrates A Year of Innovation in Support of Filipino MSMEs