Being able to handle payments digitally is a real game-changer in the bustling world of ecommerce.

Think of PESONet and InstaPay as your business buddies – they’re here to make dealing with money much simpler and safer. If you’re just starting out or running a small business, these tools can really help smooth out your day-to-day operations.

They keep the cash flowing and give you a leg up in the busy digital market. Read our PESONet vs InstaPay comparison guide and see how these digital payment methods can be super helpful as you grow your business.

Also read: Beyond COD: Shifting to E-wallets and Payment Gateways

Benefits of digital transactions for modern businesses

Digital transactions can be a real help for small businesses, and here’s how:

- Speedy payments. You get to see the money in your account faster, which helps keep the cash flowing smoothly.

- Cost savings. Fewer trips to the bank and less paperwork mean you can cut down on those extra expenses.

- Safety first. With strong security on digital platforms, there’s less worry about handling cash or dealing with checks.

- Anywhere, anytime. The beauty of digital is that you can handle payments no matter where you are, giving your business and your customers more flexibility.

- Easy tracking. All your transactions are recorded automatically, making it a whole lot easier to manage your finances.

- Wider reach. Embracing digital payments opens up new markets, letting your business grow beyond local boundaries.

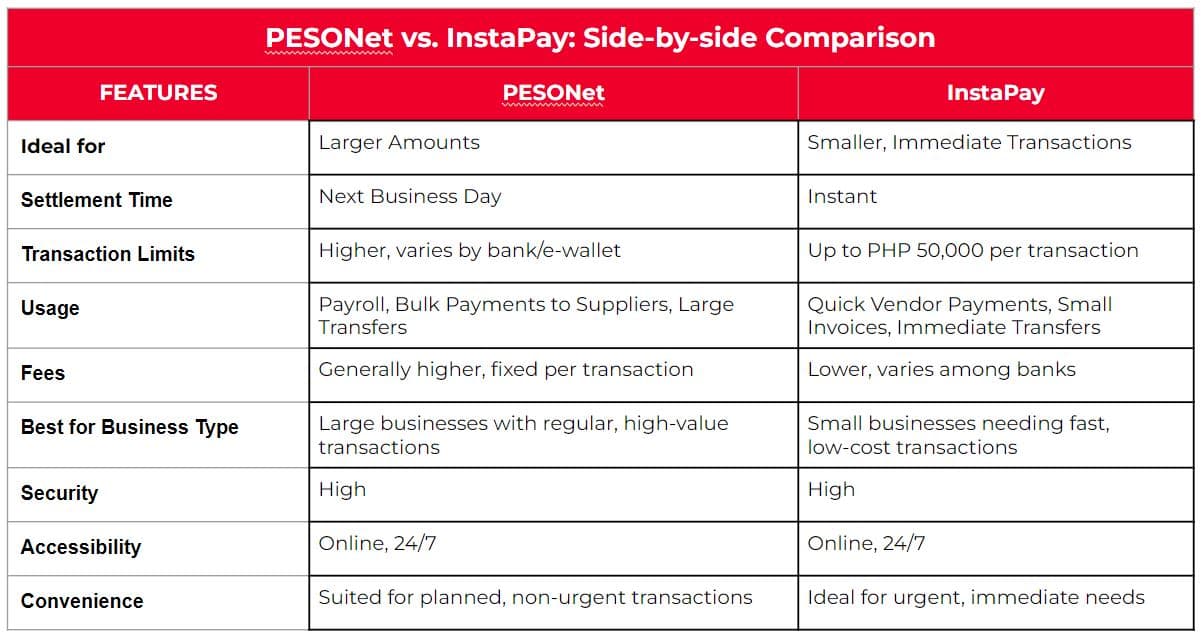

PESONet vs InstaPay: What’s the difference?

PESONet and InstaPay are two leading electronic fund transfer services in the Philippines. Both play a vital role in the Philippines’ push toward a cash-lite economy.

fund transfer platforms in the country.

PESONet

- Ideal for larger amounts. PESONet is tailored for high-value transactions. This makes it a go-to option for significant money transfers.

- Next-day settlement. Transactions done through PESONet are usually settled on the next business day. This feature is particularly beneficial for planned, non-urgent large payments.

- Broad usage. It’s widely used for payroll disbursements, making bulk payments to suppliers, or transferring large sums between accounts.

- Beneficial for businesses. For businesses, PESONet’s capacity for handling large sums efficiently makes it an excellent tool for managing major financial operations.

When to use PESONet?

PESONet should be your choice when there’s no rush for the funds to be transferred immediately. Its next-day settlement feature suits situations where planning is involved, such as monthly payroll processing or scheduled payments to suppliers.

InstaPay

- For immediate transactions. InstaPay is designed for real-time, smaller transactions. This service ensures that funds are transferred almost instantly.

- Lower value limits. While it’s great for quick transfers, InstaPay has a lower transaction limit compared to PESONet, making it ideal for smaller, everyday payments.

- Versatility for individuals and businesses: Both individuals and businesses find InstaPay useful for immediate payment needs, such as settling invoices with vendors or transferring money to another person instantly.

When to use InstaPay?

InstaPay is your best bet for urgent transactions of smaller amounts. If you need to pay a vendor quickly, settle a minor invoice, or send money to someone immediately, InstaPay facilitates these transactions efficiently and in real-time.

InstaPay vs. PESONet fees

Both services have different fee structures:

PESONet Fees: Typically, PESONet fees for high-value transactions can range from a few pesos to a higher amount, depending on the bank or financial institution. The fees are generally fixed per transaction, regardless of the transfer amount.

InstaPay Fees: InstaPay, known for smaller, immediate transfers, usually charges lower fees compared to PESONet. These fees can also vary among different banks but are often lower due to the nature of smaller transactions.

In the digital age, being savvy with your e-transactions is key to a profitable and sustainable business.

Which is better for businesses?

Choosing between PESONet and InstaPay as your electronic fund transfer option boils down to your business needs.

Think of InstaPay as your go-to for quick, small payments. It’s perfect for when you need to pay someone right away or handle daily expenses without breaking the bank with fees. If you’re running a small shop or a start-up, InstaPay helps keep things rolling smoothly because it’s fast and doesn’t cost much.

On the other hand, PESONet is like your heavy lifter. It’s great for when you have to move a lot of money, like paying all your employees or handling a big order from a supplier. PESONet works well for the big, regular payments you plan ahead for. It’s reliable and secure, which is really important when you’re dealing with larger amounts of money.

By understanding the strengths of each platform, you can make informed decisions that benefit your business’s cash flow and operational efficiency. Remember, in the digital age, being savvy with your e-transactions is key to a profitable and sustainable business.

More helpful tips for your growing business:

Is In-house Delivery A Good Option for Your Business?

Ecommerce Platform vs. Online Marketplace

Effective Pricing Tactics for Your Online Business