Imagine this: You stumble upon the perfect pair of sneakers or gadget you’ve been eyeing for months. You know you want it, but your wallet is telling you otherwise. That’s where the trend of ‘buy now, pay later’ (BNPL) comes into play. This increasingly popular payment option has taken Malaysia by storm, especially among younger generations, as they increasingly turn to online shopping. It’s a game-changer that has revolutionised how consumers shop and manage their finances in the bustling Malaysian consumer landscape.

So forget about the constraints of traditional payment methods – BNPL is the new convenience. Whether you’re a savvy shopper looking to score the latest fashion trends or an e-commerce business owner seeking to jumpstart your online business and boost sales, the trend of BNPL is here to revolutionise your experience. Ready to learn more? Let’s dive in.

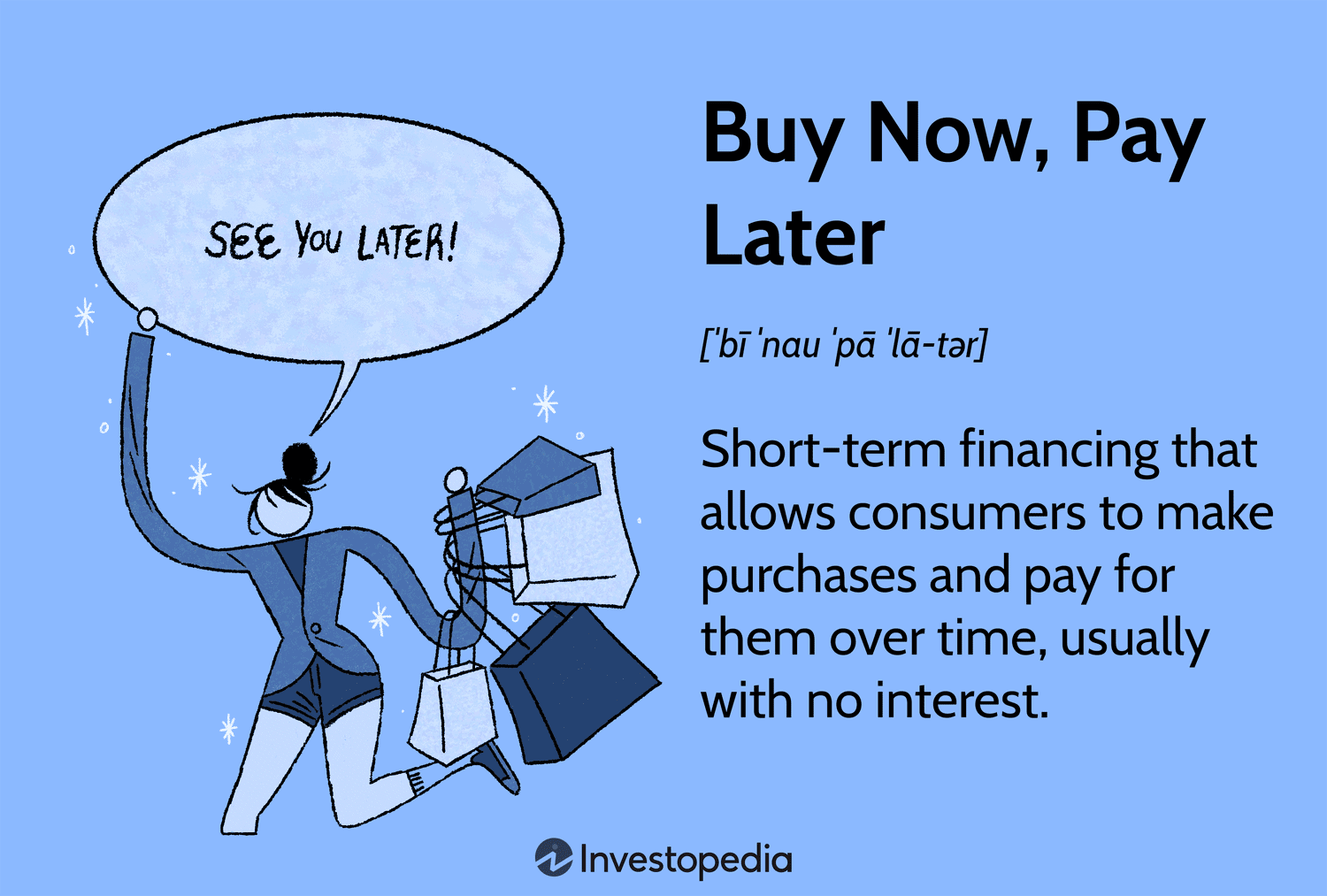

What is Buy Now, Pay Later?

At its core, BNPL is a payment option that enables consumers to ‘buy now’ by allowing them to make a purchase without paying the full amount at the time of the transaction. Instead, they can ‘pay later’ by splitting the total cost into smaller, interest-free instalments or paying the entire sum within a specified period.

This flexibility lets individuals enjoy the product immediately and spread the financial burden over time, making it an attractive and budget-friendly alternative to other traditional payment methods that may come with high-interest rates.

How does it work?

To make your purchase via BNPL, you will need to go through a third-party company or a BNPL platform such as Atome or SpayLater by Shopee in Malaysia. So once you’re ready to finalise your purchase at checkout, you should see a BNPL option among the payment methods offered by participating merchants. Upon approval, you may then be asked to make a down payment, such as the first month’s instalment. The remaining amount can then be paid via instalments or at a later time, depending on the agreed terms.

What You Should Know about Buy Now, Pay Later

At this point, you’re probably wondering if there’s a catch to this seemingly too-good-to-be-true payment option. We get it, and that’s why we’re here to give you the ins and outs of BNPL so you can approach it with confidence and steer clear of any unexpected surprises. So here’s what you need to know:

- Convenience and Flexibility: BNPL services are usually quick and seamless, as they are offered by fintech companies or platforms. Plus, it provides flexible payment plans that help you break up larger purchases into more manageable payments, easing the strain on your finances.

- Interest-Free Instalments: You read that right! Unlike your typical credit card instalments, one of the key advantages of BNPL is that it often allows consumers to divide their payments into interest-free instalments.

- Credit Scores: Most BNPL providers don’t perform credit checks, so you won’t have to worry about purchasing via instalments even with a poor credit score. But do keep in mind that late or missed payments could impact your creditworthiness.

- Late Fees and Penalty Charges: While BNPL offers convenience, it is crucial to be aware of the terms and conditions associated with the service. Late payments or failure to settle the entire amount within the agreed-upon period may incur late fees or penalty charges. Understanding these terms is essential to avoid unnecessary financial burdens.

Popular Buy Now, Pay Later Platforms in Malaysia

With a multitude of BNPL platforms available in the Malaysian market, both consumers and e-commerce businesses have a plethora of options to choose from. Here are some platforms that are making waves in Malaysia:

1. Atome

Boasting a wide network of over 2,000 online and in-store retail partners, Atome is considered one of Southeast Asia’s leading BNPL platforms. This user-friendly platform allows consumers to split their payments into three equal interest-free instalments. However, late payments may incur a penalty of RM23, with additional penalty of RM7 in certain cases.

2. PayLater by Grab

With PayLater by Grab, you get to select from two repayment options. You can opt for four monthly instalments with PayLater or pay the entire amount next month with PayLater Postpaid. PayLater can be used for Grab’s partnering merchants, while PayLater Postpaid is exclusively for Grab services like Grab riders or GrabFood. Plus, you can earn GrabRewards with PayLater Postpaid, adding extra value to your transactions. With PayLater, missing a payment will temporarily freeze your account, and an RM10 administration fee is required for reactivation. But don’t worry, the maximum fee incurred per purchase is capped at RM30.

3. SPayLater (by Shopee)

SpayLater by Shopee also provides two repayment methods to choose from. You can either pay the entire amount at the end of the month with no fees charged or spread your payments across two, three, or six months, but keep in mind there’s a 1.5% processing fee per month. Oh, and here’s a little secret: selected users may even be eligible to stretch their instalments up to 12 months! However, if you miss a payment, don’t worry. Your SpayLater account will be temporarily frozen until you settle the outstanding amount. Just a heads up, there is an RM10 reactivation fee to get your account back up and running.

Is SPayLater Malaysia Shariah Compliant?

Yes, SPayLater (including both the Pay Next Month and installment plan options) is certified as Shariah-compliant by Amanie Advisors, a reputable Shariah advisory firm in Malaysia. This means it adheres to Islamic principles for financial transactions.

So, Who Takes the Crown?

In a close race, PayLater by Grab takes the top spot in the BNPL arena, edging out SPayLater by a single point and Atome follow behind. While each service offers unique benefits and drawbacks, the ideal choice boils down to your individual needs. Since not all merchants or platforms support every BNPL provider, the available options at your preferred store also play a key role in selecting the best fit for you.

Malaysia’s Buy Now, Pay Later Craze

The latest research findings have uncovered an exciting trend in Malaysia’s consumer landscape: a remarkable surge in the adoption of buy now, pay later (BNPL) services in Malaysia. This is no surprise considering the rapid growth of e-commerce and the increasing number of tech-savvy younger-generation consumers who are price-conscious and always on the lookout for convenient payment options (Ken Research, 2023).

In fact, a report by TheStar predicts that Malaysia’s BNPL market will experience a whopping 35.4% annual growth rate from 2022 to 2028. That’s not all—the report also forecasts a potential gross merchandise value of a staggering RM29.6 billion by 2028.

These numbers can only mean one thing – the growing popularity and immense opportunities that the BNPL trend holds for both consumers and businesses alike. It’s clear that Malaysians are embracing the convenience and flexibility offered by BNPL, paving the way for a thriving digital payment landscape in the country. With consumers and businesses both reaping the benefits, the future of BNPL in Malaysia looks brighter than ever.

🐱👤 Extra perks for our readers: If you’re an ecommerce business owner, who doesn’t want to save some Ringgit on deliveries? Peep this – snag 5 FREE deliveries when you sign up on this app. Plus, they got that clutch “Ship Now, Pay Later” option. Talk about levelling up your game with some serious convenience and savings! 🚀

Is Buy Now, Pay Later Regulated in Malaysia?

Buy now, pay later (BNPL) services in Malaysia are currently in a transitional phase. While they aren’t directly regulated yet, the landscape is changing. The Consumer Credit Act (CCA) is being formulated to bring BNPL providers under the supervision of Bank Negara Malaysia (BNM). This is expected to be implemented by the end of 2024. The new regulations aim to ensure responsible lending practices and protect consumers, especially when it comes to areas like credit checks and transparent fees. So, while BNPL isn’t fully regulated just yet, it’s on the way!

Does Buy Now, Pay Later Affect Credit Score Malaysia?

The impact of Buy Now, Pay Later (BNPL) on your credit score in Malaysia is a bit uncertain at the moment. Here’s the breakdown:

- Potential Impact: Like any form of credit, BNPL usage can influence your credit score. If you consistently make your BNPL payments on time and in full, it likely won’t negatively affect your score. In fact, some platforms might not even report your activity to credit bureaus.

- Catch with Late Payments: However, if you miss BNPL payments, especially multiple times, there’s a chance the BNPL provider could report this to credit reporting agencies like CTOS or CCRIS. These late payments would then be reflected in your credit report, potentially lowering your score. This could make it harder to secure loans or credit cards in the future.

- Evolving Regulations: The Malaysian BNPL market is still under development, and regulations are being formulated. The Consumer Credit Act (CCA) is expected to be implemented by the end of 2024, bringing BNPL providers under the supervision of Bank Negara Malaysia. This might lead to standardized reporting of BNPL activity to credit bureaus in the future.

Overall, using BNPL responsibly shouldn’t harm your credit score. But remember, missed payments can be detrimental. Keep an eye on developments in BNPL regulations to stay updated on how it might affect your credit picture in the future.

Ready to take on BNPL? We’ve got something for you!

Speaking of more flexible payment options in Malaysia, did you know that Ninja Biz offers a convenient feature that allows you to ship your products first and defer payment for shipping fees to a later time?

This feature gives you greater cash flow flexibility, enabling you to manage your finances more effectively. By taking advantage of this feature, you can prioritise your business growth while ensuring top-notch service to your customers. Whether you’re a seasoned e-commerce entrepreneur or looking to set up your online store, you don’t want to miss this!