The Philippine market offers plenty of business opportunities. With a thriving economy and a large population, it’s no surprise that foreigners are interested in starting businesses catering to Filipinos, or working with Filipinos to provide international products and services.

Navigating the Philippine market and its regulations can be daunting, especially when you consider that the country once had strict foreign investment rules. However, laws have changed since 2022 to attract foreign investments, which means you may find it easier to start a business here.

Once you understand the basics of starting a business, you may find the opportunity that you want to explore. Here’s an overview of starting a foreign business in the philippines.

Also read: How to Start Importing from China to the Philippines?

Who can do business in the Philippines?

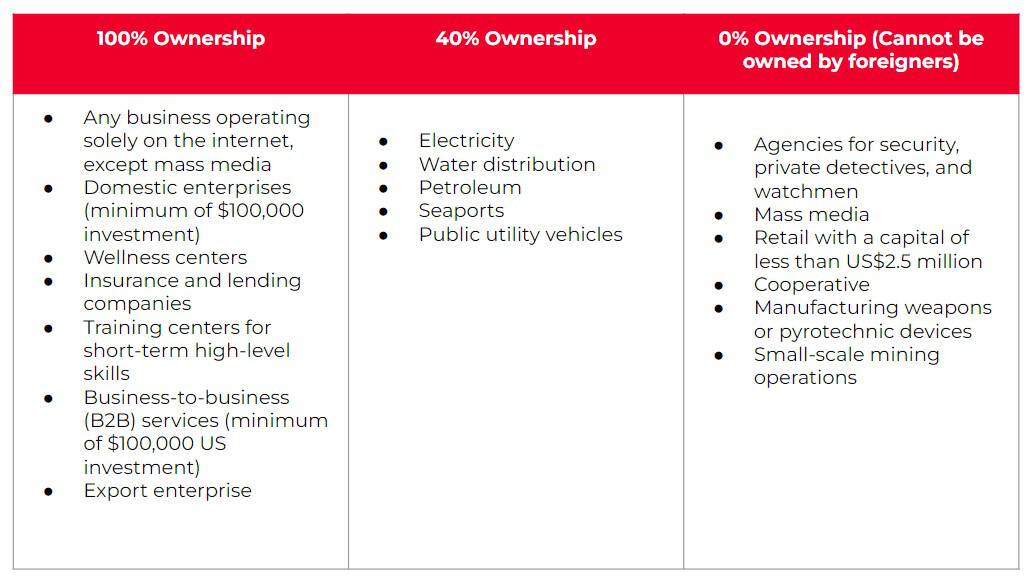

Foreigners are generally free to own businesses in the country, but there are certain restrictions.

For example, the amendment to the Public Service Act made it legal for 100% foreign-owned businesses under the telecommunications, airline and domestic shipping industries to operate in the Philippines. However, businesses that deal in sectors such as electricity, water distribution, and public utility vehicles need to be 40% foreign-owned.

Additionally, before you can register or get licenses for your business, the laws require a minimum capital (especially for corporations).

What are the benefits of starting a foreign business in the Philippines?

There are many reasons foreign business owners find plenty of opportunities here. They include:

Market opportunities. The Philippines has a population of 113.9 million, which means you’re bound to find buyers interested in your products or services.

Cost-effective labor. The Philippines has a labor market that international corporations find to be a cost-effective solution to their operations. The country has a high literacy rate, plenty of skilled professionals, and a relatively high number of English speakers.

Government incentives. The Philippine government wants to promote international trade and business opportunities to boost the economy. Thus, foreigners can expect various incentives to start a business here compared to other countries.

#NinjaTip: Choose Ninja Van when you need a reliable logistics partner in PH and Southeast Asia. We provide customized and cost-effective solutions for businesses. Talk to our experts today!

What are the types of business entities for foreign investors?

Foreigners can choose from six types of business entities:

- Domestic Corporation – a common business entity similar to a limited liability company. The corporation incurs its own liabilities and limits a foreigner’s liability only to its capital contribution.

- One Person Corporation – introduced in 2019, this entity was designed for micro, small, and medium enterprises where one stockholder acts as director and president.

- Branch Office – an existing foreign parent company creates a branch of its operations in the Philippines. It’s not a separate entity from the parent company, so the branch’s liabilities can reach the company abroad.

- Representative Office – unlike the branch office, this is a non-income-generating entity. BPO companies and companies that offer back office, call centers, and other outsourcing services fall under here as long as they don’t serve local clients.

- Regional Headquarters – a non-income generating entity for foreign corporations with other locations worldwide. They’re not allowed to have clients in the Philippines and can only serve international clients.

- Regional Operating Headquarters – generates income by carrying out the business activities of its foreign parent company.

Here are examples of businesses foreigners can open with 100% ownership, and those that can’t have foreign ownership:

What are the legal requirements for starting a foreign business in the Philippines?

The legal requirements of foreign business ownership in the Philippines can vary depending on the industry.

On top of ownership, some industries have a minimum capital foreigners have to provide to start a business in the Philippines. Additionally, there may be additional permits and documents. These, however, are usually the basics for opening a domestic corporation:

for profitable but cost-effective operations.

- Certificate of Registration – you can obtain this from the Securities and Exchange Commission.

- Articles of Incorporation and By-laws – this states the name, purpose, place of office, incorporators, capital stock, term of the Company, and other information about the business upon its establishment.

- Bank Certificate – this certificate should show the paid-up capital, the minimum depending on the revenue source and industry.

- Treasurer’s Affidavit – a sworn statement or declaration made by the treasurer or a designated financial officer to provide assurance and documentation regarding the company’s financial status.

- Registration Data Sheet – a document or form used by government agencies to collect essential information about a business entity during the registration or incorporation process.

- Endorsements and Clearances – these are documents or approvals from various government agencies or regulatory bodies to ensure compliance with local laws and regulations.

Can you start a business in PH from China?

Or, in general, can a foreigner start a business in the Philippines remotely?

While it’s challenging, it can be possible to open a Chinese business in the Philippines, especially if you’re working with a legal representative who can handle aspects, such as acquiring documents and permits in the Philippines.

If your business meets the existing laws on ownership, the minimum capital, and all other requirements, you can start your business. However, keep in mind that you can retain full ownership if your operations meet certain criteria.

If you want to start a business that sells to the local market, your ownership may go down to 40%.

#NinjaTip: 您是正在菲律宾寻找可靠物流合作伙伴的中国企业主吗? 用您喜欢的语言了解Ninja Van服务. 或者与我们讲中文的客户经理讨论您的运输需求。立即联系我们!

How can Ninja Van help you?

If you need a reliable logistics partner for your business in the Philippines, Ninja Van is here to provide customized solutions to meet your needs.

We provide a one-stop-shop and cost-effective logistics services — from sourcing and procurement to cross border ecommerce, and fulfillment and warehousing.

And of course, we’ll give you hassle-free deliveries all over the country.

Talk to our experts today to learn more about our services and to discuss your logistics requirements.

Follow Ninja Van on WeChat: