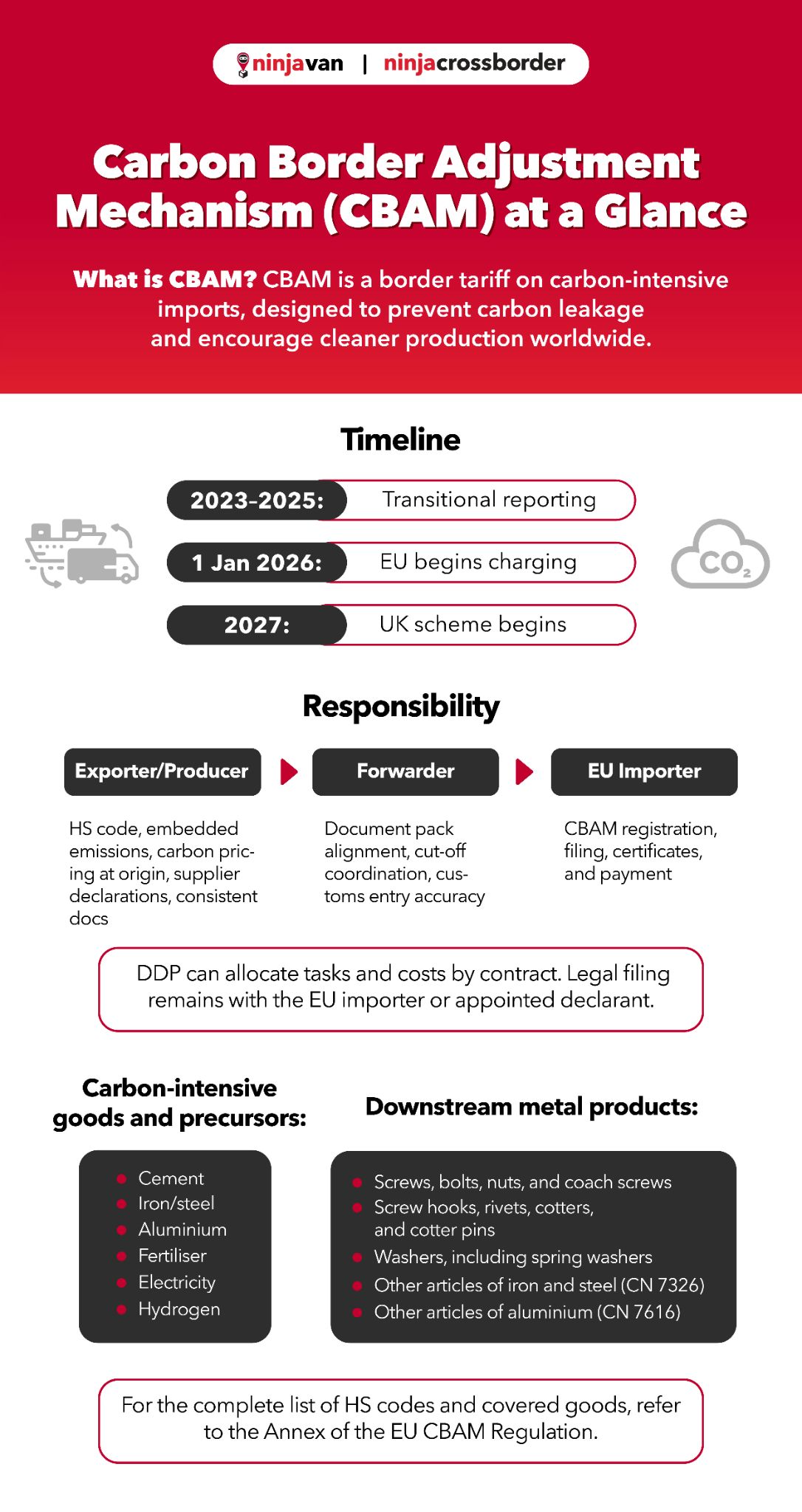

From 1 January 2026, the European Union (EU) will begin charging for carbon emissions embedded in imports under the Carbon Border Adjustment Mechanism (CBAM). The United Kingdom (UK) will follow with its own scheme in 2027.

For Malaysian exporters of steel, aluminium, cement, fertilisers, electricity, and hydrogen, CBAM is more than a policy shift. It directly affects freight forwarding in Malaysia, from HS code accuracy and emissions data to documentation and buyer communication.

Get this right, and shipments clear smoothly. Get it wrong, and costs, disputes, or delays are almost certain.

What is the Carbon Border Adjustment Mechanism (CBAM)?

CBAM applies a carbon price to certain imports so they face a similar cost to goods produced under EU climate rules. EU importers file and pay, but they rely on Malaysian sellers and their forwarders for accurate product classification and embedded emissions data.

What Products Are Covered by CBAM

CBAM does not apply to all Malaysian exports. Instead, it focuses on carbon-intensive goods and a limited number of downstream products that are considered at higher risk of carbon leakage.

If you manufacture, trade, or consolidate these products for export to the EU or UK, you will need to prepare for stricter reporting and documentation.

Carbon-intensive goods and precursors:

- Cement (including clinker and related inputs)

- Iron and steel products, plus precursors such as iron ore pellets

- Aluminium and selected fabricated aluminium articles

- Fertilisers and chemical precursors like ammonia and nitric acid

- Imported electricity

- Hydrogen

Downstream metal products:

- Screws, bolts, nuts, and coach screws

- Screw hooks, rivets, cotters, and cotter pins

- Washers, including spring washers

- Other articles of iron and steel (CN 7326)

- Other articles of aluminium (CN 7616)

For the complete list of HS codes and covered goods, refer to the Annex of the EU CBAM Regulation.

What EU Buyers Will Ask From You

Even though CBAM certificates and filings are handled by the importer in Europe, Malaysian exporters play a crucial role.

Your EU buyers cannot complete their submissions unless you provide the right documents and data. This makes CBAM a practical shipping and freight forwarding concern, not just a compliance formality.

Here’s what your EU buyers are likely to request for every shipment:

- HS code confirmation: A final HS code for each product line, ideally supported by a short memo that justifies the classification.

- Embedded emissions data: At the plant or product level, showing process energy use, emissions, and calculation method. Where available, an Environmental Product Declaration (EPD) can be used.

- Proof of carbon pricing at origin: Any verified carbon tax or charge paid in Malaysia that may qualify as a deduction under CBAM.

- Supplier declarations and quality documents: Items such as mill test certificates, bills of materials, or attestations from upstream suppliers.

- Consistent documentation: The same HS codes and product descriptions across the commercial invoice, packing list, and customs declaration to avoid mismatches at clearance.

Shipment Workflow to Stay Compliant

Getting shipments CBAM-ready means adjusting your export process. Here is a simple workflow Malaysian exporters can follow:

- Confirm HS codes early and align descriptions across invoice, packing list, and customs entry.

- Collect emissions data and supplier declarations before booking to avoid last-minute delays.

- Build a CBAM dossier for each product that includes the HS memo, emissions data, and supporting documents.

- Share the dossier with your forwarder and buyer on agreed cut-off dates.

- Book with buffer time in case customs queries arise at EU ports.

- Close the loop after arrival by confirming your buyer’s CBAM submission and storing proof with your shipment file.

This structure keeps your shipping operations predictable and your EU buyers compliant.

Costs and Incoterms

CBAM adds a carbon-related cost that your EU buyer must cover, but Malaysian exporters influence how smoothly that cost is managed. Accurate data reduces reliance on default values, which often inflate the carbon bill. Incoterms also shape responsibilities:

- Ex Works (EXW), Free on Board (FOB), Cost and Freight (CFR), Cost, Insurance and Freight (CIF): The EU buyer files and pays CBAM, but relies on the non-EU exporter for complete documentation and emissions data.

- Delivered Duty Paid (DDP): Under DDP, the exporter assumes import responsibilities, including emissions reporting. Therefore, contracts must clearly delineate ownership of data, reporting duties, and cost allocation.

Setting these roles in writing avoids disputes and keeps shipments on track.

CBAM Costs: How Malaysian Exporters Can Prepare

From 2026 in the EU and 2027 in the UK, CBAM shifts from reporting to real costs. For Malaysian exporters of steel, aluminium, cement, fertilisers, electricity, and hydrogen, compliance is not optional. Covered goods cannot enter Europe without a valid CBAM filing.

The only question is how ready you are. Accurate HS codes, emissions data, and clear Incoterm roles will keep buyers confident and shipments moving. With the right freight forwarding partner, CBAM becomes a process you can manage, not a barrier to trade.

Stay shipment-ready for CBAM with Ninja Freight, with on-time deliveries and full logistics visibility. Contact us to keep your shipments to Europe moving without delays.