Running a business has its fair share of headaches — from juggling daily operations to staying on top of trends, and then there are those unexpected surprises. But let’s be real, the thing that keeps most of us up at night is cash flow.

One minute, your business is riding high and next, you’re hit with sudden expenses or market shifts that make you think, “What just happened?” This is where the importance of a cash buffer for small businesses really comes into play.

But how much cash should you actually set aside? Let’s explore some practical tips and real-world examples for small business owners and managers who want to stay on their toes, ready for whatever comes next.

Understanding Cash Buffer

Think of a cash buffer as your financial safety net. It’s the extra cash that helps you cover the unexpected, whether that’s a sudden drop in sales, a last-minute opportunity, or something else entirely. Cash buffers give you the flexibility to respond quickly and strategically without scrambling for loans or cutting essential costs.

Unlike your everyday cash flow, which is all about managing regular expenses like payroll and bills, a cash buffer is meant for the “just in case” scenarios. It’s not money you rely on daily but rather a reserve that you can tap into when the going gets tough.

Determining how much cash buffer a business should maintain is crucial, as it depends on factors like business size, industry, and risk tolerance, which we’ll explore further below.

3 Benefits of Maintaining a Cash Buffer

If you’re still on the fence about building a cash buffer, let’s talk about benefits. For starters, having cash on hand provides peace of mind. It’s like having a secret weapon you can pull out when things get tricky. Here’s why it matters:

- Financial Stability: Life throws curveballs — maybe it’s an unexpected bill, or maybe a supplier raises prices. With a cash buffer, you can handle these hiccups without derailing your business. It’s just a natural part of your financial planning for unexpected business changes.

- Opportunity Seizing: Sometimes, a fantastic opportunity comes knocking. If you have extra cash, you can jump on these chances instead of watching them pass by.

- Negotiation Power: Ever tried negotiating with suppliers or partners when you’re tight on cash? It’s not fun. A cash buffer strengthens your position, letting you bargain from a place of security.

Not to mention, delivery inefficiencies can significantly impact businesses across various industries, as they not only add to operational costs but also erode profitability over time. Addressing these inefficiencies is essential to preserving cash reserves and ensuring long-term success.

For instance, e-commerce businesses find this challenge even more pronounced, as inefficient deliveries can quickly chip away at both profits and cash flow. However, by partnering with a reliable delivery service, this challenge can easily be resolved as businesses can optimise logistics, reduce costs, and set themselves up for sustained growth.

4 Things to Determine Your Cash Buffer

So, here comes the big question: how much cash buffer should your business have? Well, it depends. Every business has unique needs, but generally speaking, there are some guidelines to consider.

- Business Size and Industry: Bigger companies often need bigger buffers. The same goes for industries with high operational costs or fluctuating demand.

- Seasonal Fluctuations: Does your business ebb and flow with the seasons? If so, you’ll want a larger buffer to cover the slower periods.

- Economic Climate: In times of economic uncertainty, it’s wise to boost your buffer. This provides extra breathing room if things get rough.

- Risk Tolerance: How much risk can you comfortably handle? If you’re more risk-averse, a larger buffer can help you sleep better at night.

3 Recommended Buffer Amounts for Different Businesses

Now, let’s get specific. Here’s a general guideline to help you figure out how much cash to keep based on your business type:

- Startups: Since these businesses are just getting off the ground, aim for at least six months’ worth of operating expenses. You’re in the growth stage, and that extra cash can help weather the inevitable storms.

- Established SMEs: These businesses usually have more predictable cash flows, so three to six months’ worth of expenses should suffice. You’ve likely got some stability, but the buffer ensures you stay agile.

- Seasonal Businesses: You know the drill—booms and slumps. Keep a buffer that covers you during the off-season. This could mean having six to nine months’ worth of cash reserves.

For instance, a local café might only need a three-month buffer, in contrast, property developers like UOA Development doubled their cash positions in 2020 through strategic asset sales to strengthen financial stability.

4 Best Tips for Building and Maintaining Cash Buffer

Building a cash buffer doesn’t happen overnight, but the good news is that small steps can make a big difference over time. Here’s how you can get started:

- Budget and Forecast: Know your monthly expenses and forecast any upcoming costs. This helps you set realistic goals for your buffer.

- Set Aside Revenue: Decide on a percentage of your revenue to put towards your buffer each month. It might be 5%, or maybe 10%—whatever feels manageable.

- Monitor Cash Flow Regularly: This way, you can spot trends or potential issues early and adjust your buffer strategy accordingly.

- Evaluate Delivery Options: Delivery inefficiencies can eat into your cash reserves, so it pays to optimise this part of your business. Ninja Van’s Business Delivery Service, for instance, offers competitive pricing and personalised support to help you avoid costly delays.

By following these steps, you’ll gradually build up a buffer that fits your needs. It’s all about consistency and commitment—small efforts add up over time.

Safeguard Your Profits with Smarter Inventory Management

Now that you understand the importance of maintaining a solid cash buffer, it’s crucial to take proactive steps to ensure it stays optimized without being compromised by issues like stockouts or seasonal high demands.

One of the most overlooked ways cash reserves get depleted is through inefficient inventory management—especially when it comes to delivery delays or unexpected stock shortages.

Hidden Threats of Delivery Inefficiencies

Inefficient deliveries and poor restocking practices can quickly leave your business vulnerable when you need your cash buffer the most.

When inventory isn’t replenished on time, businesses are forced to scramble, often paying higher prices to meet demand or missing out on sales opportunities altogether—eroding profits.

This not only strains your operations but also eats into the cash buffer that should be reserved for true emergencies.

3 Powerful Reasons Why Ninja Restock is the Smart Solution

This is where Ninja Van’s B2B restocking insights come into play, helping businesses stay ahead of their inventory needs without draining their cash reserves. Ninja Restock offers several advantages, such as:

- Competitive pricing based on cubic metres (CBM), allowing you to control costs and keep your expenses predictable.

- A dedicated account manager who provides personalized support to help you streamline your inventory replenishment process and address any logistics concerns before they impact your cash flow.

- Daily delivery runs, ensuring timely and consistent inventory replenishment, so you can avoid stockouts, capitalize on high-demand periods, and protect your cash buffer.

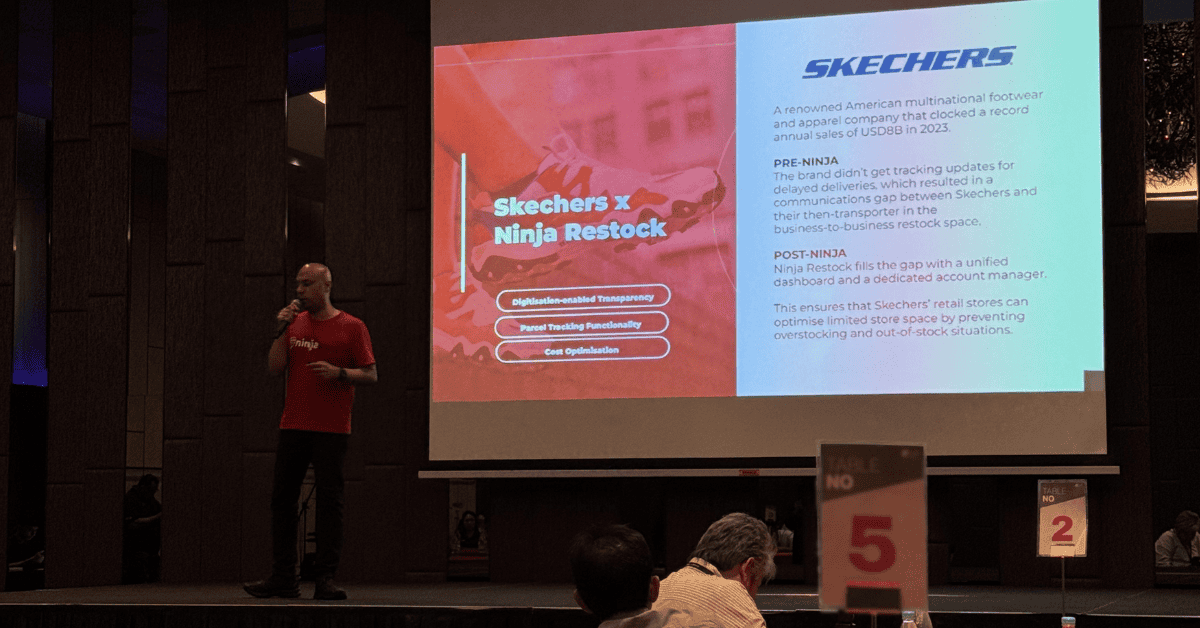

Ninja Van Reinvents B2B Restocking

By maintaining consistent inventory levels with reliable delivery, you can keep your cash buffer strong—preventing disruptions that force you to dip into your emergency funds.

As mentioned by Clarence Fernandez, Head of B2B express, Ninja Van Malaysia, with smart inventory planning and efficient logistics, your cash buffer can remain intact, allowing you to seize opportunities and respond to unexpected challenges without financial strain.

Partner with Ninja Van to Protect Your Profits

Don’t let delivery inefficiencies erode your hard-earned profits. Partner with Ninja Van to enhance your delivery efficiency, safeguard both your inventory and cash reserves, and keep your business resilient and profitable, no matter what surprises come your way.

Contact us today to learn more and get a price quotation. Efficient inventory replenishment awaits!