Is Buy Now Pay Later (BNPL) better than a traditional credit card? Or is it just another way to stay stuck in debt longer?

In this article, we break it down with real Malaysian context, so you can make smarter financial decisions.

💳 What’s the Real Difference Between Credit Card and BNPL?

Before diving into debt outcomes, here’s a quick side-by-side:

| Feature | Credit Card | BNPL (Buy Now Pay Later) |

|---|---|---|

| Interest | Up to 18% p.a. if unpaid | 0% for short term (usually 3-6 months) |

| Credit Score Impact | Yes – affects your CCRIS | No official CCRIS reporting (yet) |

| Late Payment Penalty | Yes – compound interest & fees | Yes – flat fees or service charge |

| Eligibility | Requires income proof, stable job | Easier sign-up (even students) |

| Spending Limit | Based on income, credit history | Capped per transaction or monthly limit |

🧾 Credit Cards: What Happens If You Pay Late + Who Can Apply?

To get a credit card in Malaysia, you usually need to earn at least RM2,000–RM3,000 a month. Banks will ask for your payslip or tax form to check that. If you’re earning more, your spending limit will also be higher — usually around 2x your monthly salary.

But here’s the tricky part: late payments.

If you don’t pay your bill on time, you’ll get hit with:

- Late fees (around RM10–RM50)

- Interest charges of up to 18% a year

- And worst of all — the interest keeps adding on top of each other every month (compound interest)

So a small RM200 bill can quietly grow into something much bigger if you ignore it.

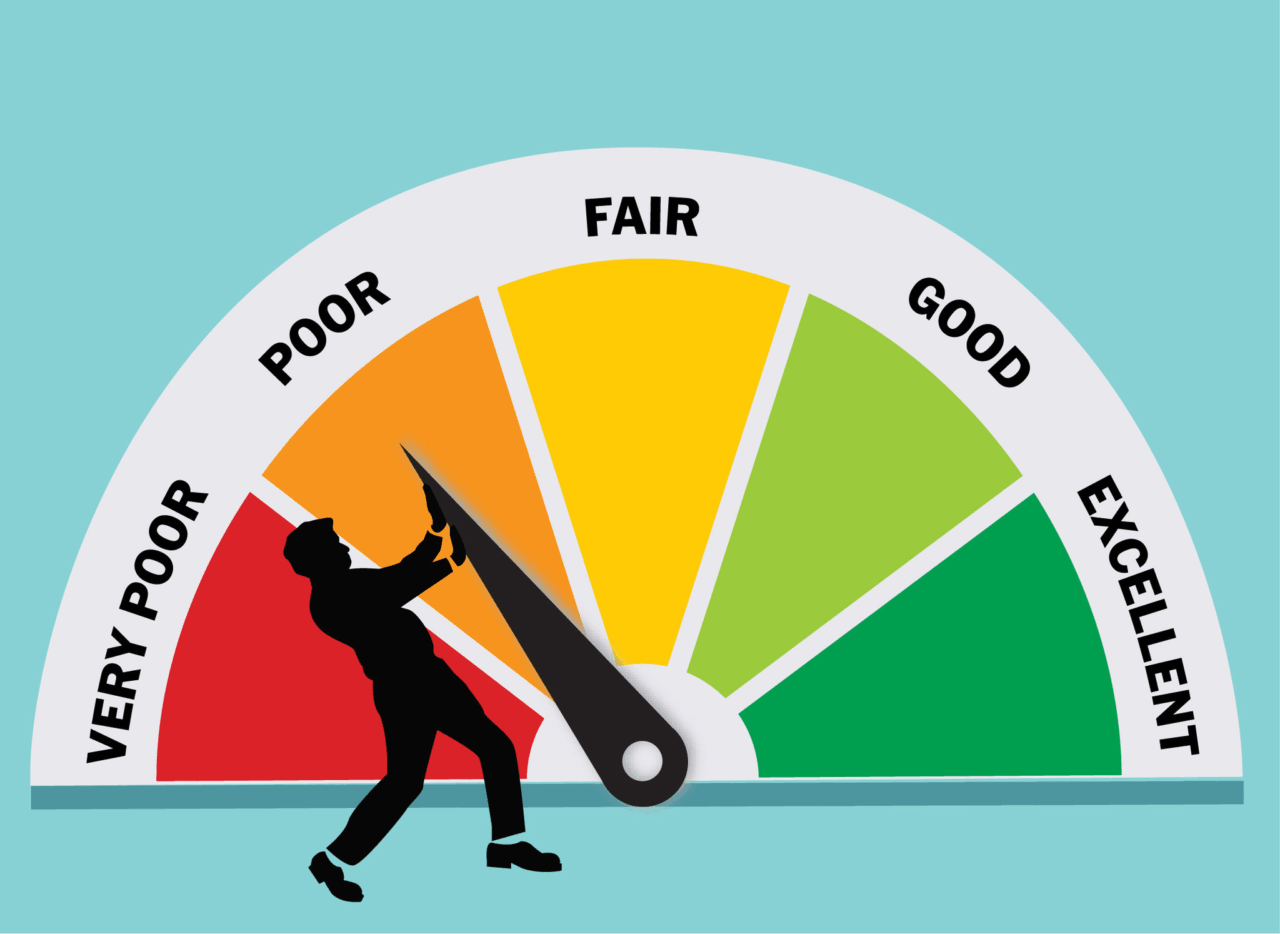

🧠 What Is CCRIS and Why Does It Matter?

CCRIS is a credit report system run by Bank Negara Malaysia. Every time you use your credit card, take out a loan, or miss a payment — it’s all recorded here.

When you apply for a car loan, home loan, or even another credit card, banks will check your CCRIS report to see if you’re a good payer.

If your payments are late, it stays in your report and makes it harder to borrow money in the future.

⚠️ BNPL doesn’t report to CCRIS yet, so missing payments won’t affect your credit score — but that could change soon.

So, ultimately, BNPL feels safer, but is it really better when it comes to paying off debt?

🚨 Debt Trap or Debt Hack? Let’s Talk Real-Life Scenarios

Scenario 1: BNPL for a RM600 Phone (3-month installment)

- Monthly payment: RM200

- Interest: 0%

- Total paid: RM600

- Late payment? RM30 flat fee or 1.5% late charge per platform

- Credit Score Impact? ✅ No reporting to CCRIS

👉 Outcome: If you stick to the plan, you’re debt-free in 3 months. But miss a payment? No credit score damage — but the fees add up silently.

Scenario 2: Credit Card for the Same RM600 Phone

- Minimum payment: RM30/month

- Interest if unpaid: Up to 18% p.a.

- Total paid over 6 months: ~RM640–RM700 (if only minimum paid)

- Late payment? Compound interest + RM10–RM50 late fee

- Credit Score Impact? ⚠️ Yes – delayed payments hurt your CCRIS profile

👉 Outcome: It may take you much longer to pay off, and your credit score takes a hit if you’re inconsistent.

⚖️ So… Is Buy Now Pay Later Better Than a Credit Card?

✅ BNPL is better for short-term, fixed payments.

No interest. Clear schedule. Great for self-discipline.

❌ BNPL is bad if you use multiple platforms and forget due dates.

You’ll pile up fees fast — and unlike credit cards, no single statement shows your total debt.

⚠️ Credit cards reward long-term users — only if you’re consistent.

Pay in full every month? You build a healthy credit score and get perks. But once you fall behind, it’s harder to catch up.

🧠 Is Buy Now Pay Later Bad for Your Credit Score?

Currently, BNPL platforms in Malaysia like Atome, SPayLater, and Grab PayLater do not report to CCRIS. So technically, no, it doesn’t affect your credit score — yet.

But don’t get too comfortable. BNPL providers are starting to collect credit data, and future unpaid balances may show up on your record.

So if you’re asking:

👉 “Is Buy Now Pay Later bad for your credit score?”

Answer: Not now, but soon it could be. Use it wisely.

🧾 What Happens to Unpaid Credit Card Debt in Malaysia?

- You’ll be charged interest (up to 18%) on the balance.

- Missed payments go into CCRIS – affecting future loan approvals.

- Banks can initiate legal action or debt collection after long-term non-payment.

🔒 Legal Actions Banks Can Take for Unpaid Credit Card Debt in Malaysia

1. Letter of Demand (LOD)

- First, the bank will send you a formal notice asking you to pay the outstanding debt within a set time (e.g., 14–21 days).

- If you ignore this, they may proceed with legal action.

2. Lawsuit / Civil Claim

- The bank can sue you in court to recover the debt.

- If the court rules in their favor, they’ll get a judgment stating that you owe the amount.

3. Writ of Seizure and Sale

- Once the bank has a court judgment, they can request a writ to seize your assets (like electronics, cars, or valuables).

- These items can be auctioned off to repay the debt.

4. Garnishee Order

- The bank can ask the court to deduct money directly from your salary or bank account to pay the debt.

- This happens through your employer or bank — and it’s legal once approved.

5. Bankruptcy Proceedings

- If your debt exceeds RM100,000 and remains unpaid, the bank can file a bankruptcy petition.

- Being declared bankrupt in Malaysia means:

- You can’t travel overseas without permission

- You lose control of your finances

- You can’t own property or run a business until discharged

💡 Note: Legal action is usually the last resort after months of non-payment and failed negotiations. But it’s very real and can have serious consequences if ignored.

This is where BNPL has an edge — it’s not connected to your long-term credit health (yet). But if you’re late, your account may get suspended or blacklisted by the BNPL platform.

🏁 Final Verdict: Which One Gets You Out of Debt Faster?

| If You’re… | Choose BNPL | Choose Credit Card |

|---|---|---|

| Wanting a short-term item | ✅ | ❌ |

| Already have other debts | ✅ | ❌ |

| Needing to build credit score | ❌ | ✅ |

| Can commit to full payment | ✅ | ✅ |

| Bad at tracking multiple bills | ❌ | ✅ (single statement) |

📌 Conclusion

Both tools can either help you or haunt you — depending on how you use them.

BNPL is great for short-term goals, while credit cards reward long-term discipline. But remember: debt isn’t bad. Staying in it for too long is.

✨ TL;DR

- Is Buy Now Pay Later better than a credit card? — Yes, for short-term purchases with discipline.

- Is Buy Now Pay Later bad for your credit score? — Not now, but it could be soon.

- What happens to unpaid credit card debt in Malaysia? — You get interest, fees, CCRIS records & risk legal action.

- Is a traditional credit card better than a BNPL? — Yes, if you want to build credit — no, if you want interest-free short-term flexibility.