Let’s face it, wala kang kawala sa tax. If you run an unregistered online negosyo, you also run the risk of the Bureau of Internal Revenue (BIR) calling on you to pay your online business tax obligations to the government — yes, not even ecommerce business owners are outside the BIR’s purview!

The Department of Trade and Industry expects to register one million ecommerce businesses in the Philippines in 2022, as popular online shops like Lazada and Shopee report seeing increases of up to 3 million visits a month over the past year.

With these rising numbers, the BIR has been forced to clarify online sellers’ tax obligations. In the next few paragraphs, we’ll sketch out what the BIR expects from you as an online seller, but we strongly recommend you talk to a tax expert for a clearer picture of your obligations.

BIR lays down the law for online sellers

Whether you have a physical store or not, as long as you earn an income within the Philippines, you are subject to taxes and filing requirements. Yes, even for online businesses: in 2013, BIR issued Revenue Memorandum Circular (RMC) 55-2013 covering taxpayers’ obligations for online business transactions.

The circular confirms that the BIR sees no distinction on whether a business’ operations are physical or online — for both cases, the tax treatment for the sale of goods or services shall be equally applied.

For online sellers (not freelancers providing a service), RMC 55-2013 recognizes these common types of online business transactions:

- Online shopping or online retailing – when online sellers sell goods or services through an ecommerce portal or virtual shops.

- Online intermediary services – where an intermediary receives a commission or incentives for successfully generating sales for a principal seller.

In 2020, the BIR issued RMC 60 -2020 in the wake of the sudden increase in online selling; the circular reminds online sellers that they are obligated to register with the BIR, and register previous years’ income (not just for 2020).

Your online business tax obligations

The taxes you’re obliged to pay varies on a case-by-case basis. Online sellers should expect to pay the following categories of taxes on their sales, depending on the income they’re pulling in.

a) Income taxes

If your online business earns more than ₱250,000 but not more than ₱3 million a year in sales, you need to pay income tax on your profits.

The government gives you two options for your income tax bill. You can either pay a flat 8% tax from your annual gross sales over ₱250,000 or follow the tax prescription based on the graduated income tax (0% to 35%) as prescribed by Tax Reform for Acceleration and Inclusion Act (TRAIN).

If your income is under ₱250,000, good news: the TRAIN law exempts you from paying taxes (you are still required to register your business, though).

Also Take Note of These Tax Exemptions for MSMEs

#NinjaTip: Paying the graduated income tax can actually come out cheaper than the flat tax, particularly if you have large operating expenses (like personnel or inventory) that can be deducted from your annual revenue!

b) Quarterly Percentage Tax

Online sellers whose annual gross sales do not exceed ₱3 million, and are therefore exempt from value-added tax (VAT) under the tax laws, must pay a percentage tax every quarter, on top of the income tax.

The regular percentage tax is 3% of gross sales or receipts earned in that quarter. The CREATE Law, however, lowers this to 1% from 2020 to 2023 to compensate for business losses during the COVID-19 pandemic.

c) Value Added Tax (VAT)

Online sellers whose annual gross sales go over ₱3 million must pay VAT representing 12% of the gross selling price of goods sold.

These are just very simple explanations of the types of tax that freelancers or self-employed and sidelining online sellers must expect to pay. These can only give you an idea of your tax bill, but not the complete picture.

As we said earlier, you will need to consult a tax specialist to get a better idea of your online sales tax obligations, based on the particulars of your business.

Also read: Take Note of These Tax Exemptions for MSMEs

Three scenarios for paying your online business tax

Let’s consider three different scenarios, which will roughly illustrate how you calculate your ecommerce business taxes based on your gross yearly income. There are lots of “if/then” in there, which is why you need to talk to a tax professional to sort this out!

Scenario 1: less than ₱250,000 in annual sales

You’re completely reliant on your online store to sell Korean makeup. Your annual sales add up to only ₱220,000 a year. This means you pay zero taxes, zero. You will still need to file your income tax return.

And you need to work on your selling game!

Scenario 2: over ₱250,000, less than ₱3 million in annual sales, flat tax

You make ₱600,000 a year selling “Squid Game” replica jackets. (Green is really your lucky color).

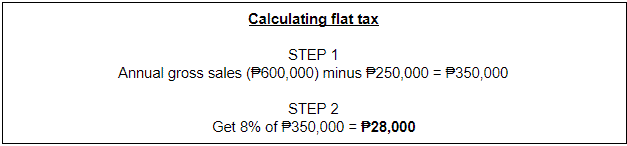

To calculate your flat 8% income tax, subtract ₱250,000 from your annual gross sales and get 8% of the result. Remember, under the flat tax, you’re not allowed to deduct any expenses.

But wait, there’s more! You also need to pay 1-3% in quarterly percentage tax. Let’s say you’re earning an even ₱150,000 every quarter in gross sales, so 1% of that (under the CREATE Law’s 1%) is ₱1,500 every quarter. After 2022, the quarterly percentage tax rises to 3%, so revise that to ₱4,500 every quarter.

So your total tax bill this year adds up the income tax plus the quarterly percentage tax: ₱34,000 total taxes, or ₱46,000 starting in 2023.

Scenario 3: over ₱250,000, less than ₱3 million in annual sales, graduated tax

Alternatively, you can choose to pay the graduated income tax under the TRAIN Law. You’re still selling green “Squid Game” jackets, still making annual gross sales of ₱600,000. But under this scheme, you’re allowed to deduct your business expenses.

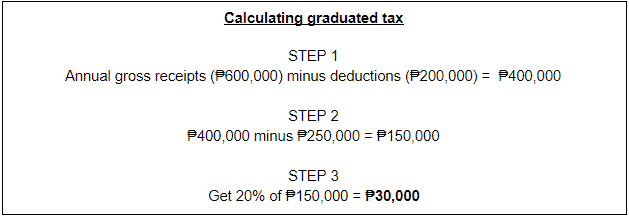

Let’s say the cost to have the jackets made (raw materials, hiring the seamstresses, packing) plus shipping via Ninja Van all adds up to ₱200,000. According to the graduated table, you belong to Bracket #2, meaning your tax rate is 20% of earnings in excess of ₱250,000. Your income tax is thus:

Don’t forget the 1-3% in quarterly percentage tax. Using the previous calculation, this means your total taxes this year add up to ₱36,000, or ₱48,000 starting in 2023.

Making more than ₱3 million annually in “Squid Game” jacket sales? This means you have to pay VAT as well, which is a whole article in itself, and really needs a tax professional to explain.

What you should do next

Kung wala kang takas sa tax, might as well do it properly. These are the next steps you should take to make your business good with your tax obligations:

Talk to a tax expert

An accountant with intimate knowledge of tax law can give you a clearer idea of your online business tax bill, which will change according to your business’ situation. They can give you advice on when and how to file your taxes; the paperwork involved; and tips on how to minimize your online sales tax by taking advantage of loopholes.

#NinjaTip: Online sellers may be eligible to apply as a Barangay Micro Business Enterprise (BMBE), which will exempt you from paying income taxes. Other incentives and benefits include a minimum wage exemption, a special credit window in select banks, and access to government business development services for barangay microenterprises.

Register your online business

This is your way to get your business officially recognized by the government. Registering your ecommerce business requires a multi-step process that involves at least three government bodies (BIR, DTI and your city government):

- You’ll need to register your business name at DTI

- Get a barangay clearance and mayor’s permit from City Hall, and

- Register your business at BIR.

Once you’ve registered your business, you’ll need to follow certain steps like clockwork over the financial year. You’ll need to issue official receipts (ORs) and sales invoices to your customers, then record all business transactions on your books of accounts.

You’ll also need to start withholding taxes from your proceeds, so you can pay your tax obligations without delay. Quarterly and annually, you’ll need to file tax returns with BIR, so you can report your income and any deductions you are authorized to claim.

Seems scary? It shouldn’t be: when you’re signed up with the tax authorities and paying your online business taxes on time, you’ll realize just how good it feels to know you won’t worry na hahabulin ka ng BIR. You’re also paying your dues for maintaining government services!

Good citizenship, after all, comes at a cost — but that cost is lighter than you think it is.

Featured image by 12963734 via Getty Images